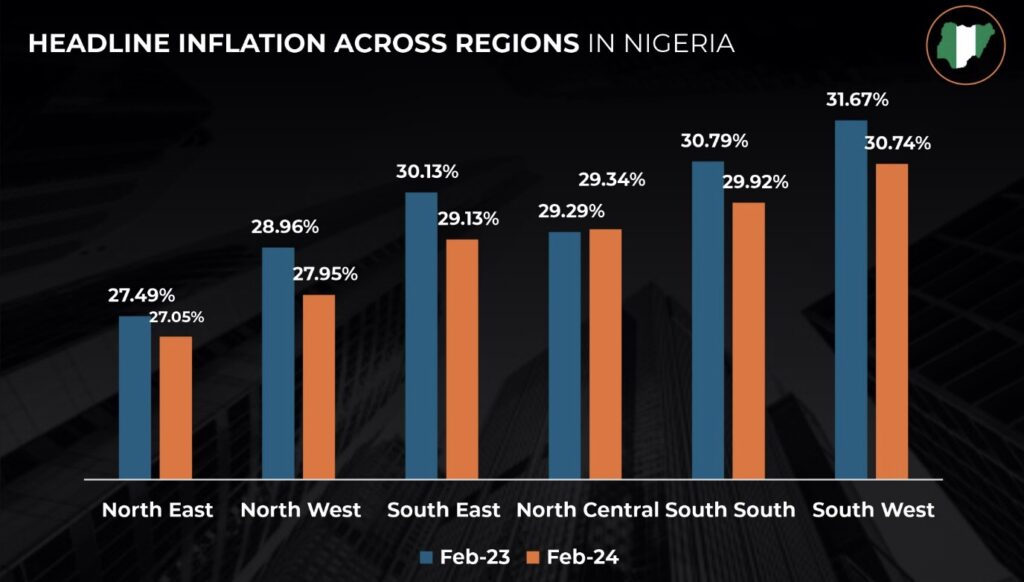

Nigeria’s real estate sector, long considered a pillar of economic development, faces a daunting challenge – inflation. As of March 2024, Nigeria’s inflation rate stands at a staggering 33.20%, according to the most recent data from the National Bureau of Statistics (NBS)

“Looking at the movement, the March 2024 headline inflation rate showed an increase of 1.50% points when compared to the February 2024 headline inflation rate,” said the NBS.

This rise in the cost of living casts a long shadow over the real estate market, threatening its stability and future growth.

The Dark Side Of Inflation

Crushing Construction Costs: It is no more news that inflation directly skyrockets prices for building materials like cement, steel, and timber. A February 2024 report by The Guardian Nigeria highlights a 60% increase in cement prices alone. This significantly increases development costs for builders, squeezing profit margins and potentially stalling projects.

Homeownership Dreams on Hold: With high inflation impacts on construction cost, buying a property has become an almost unattainable dream for many Nigerians. A recent survey by PwC Nigeria revealed that 72% of potential buyers consider inflation a major barrier to homeownership. This reduces overall demand, particularly for new developments facing inflated construction costs.

Investment Uncertainty Reigns: The volatile economic climate which is fueled by high inflation also results in uncertainty for investors. Large-scale real estate projects require significant capital investment, and with unclear returns due to inflation, investors become hesitant to commit. This could lead to a slowdown in new developments, further hindering overall market growth.

Inflation can have a ripple effect on the entire economy, impacting everything from food prices to disposable income. This can further dampen investor confidence and reduce overall economic activity, potentially slowing down the real estate market.

Innovation as a Lifeline

Shifting Focus to Rentals: As homeownership becomes less attainable, there might be a rise in demand for rental properties. This could benefit investors who own existing properties and cater to the growing population.

Affordable Housing Remains Key: The need for affordable housing in Nigeria remains ever-present. Developers who can cater to this segment by providing innovative and cost-effective solutions might see continued success.

The Path Forward: A Collective Effort

The future of Nigeria’s real estate market hinges on the government’s ability to effectively combat inflation. At this point it’ll be reasonable enough to beckon on everyone involved in this sector to play a role in taking out this dark shadow.

Government Initiatives: The government can play a role by implementing policies that encourage the use of locally-sourced building materials to reduce reliance on imports and potentially lower construction costs. Additionally, streamlining regulations and facilitating access to land could stimulate development in the affordable housing sector.

For Investors: Investors can explore alternative investment options within the real estate market, potentially focusing on the growing rental sector. They can consider investing in innovative construction methods or materials that are more cost-effective in the current climate.

For Potential Homeowners: Potential homebuyers can explore alternative financing options and consider creative solutions like co-ownership models to pool resources for property purchases. Researching government initiatives or programs that might offer future assistance with homeownership is also advisable.

While addressing national economic policy is beyond the scope of this article, some experts suggest that implementing policies to control food inflation could work in tandem with efforts to strengthen the naira. This combined approach could potentially help stabilize the overall economy and benefit the real estate sector as well.

By embracing innovation and working together, stakeholders in Nigeria’s real estate market can overcome some challenges posed by inflation and ensure the sector thrives to be a vital driver of economic growth and development.

In navigating the complexities of the current market, potential homebuyers and investors will benefit from partnering with reliable and profitable industry experts. Whether you’re seeking assistance with exploring alternative financing options or identifying suitable investment opportunities, Muna Real Estate‘s team of experienced professionals can provide valuable insights and support.

Very Insightful

Spot on analysis, well done.

Nice target points.

Tnx for bringing in possible solutions after stating the problem. Interesting work.

Educating. Weldone Ma

I love the writeup made it really easy to understand the inflation market.