There’s a ghost city in Nigeria!

I once walked through what was supposed to be a modern estate on the outskirts of Port Harcourt. It had roads that led nowhere, gates that guarded ghosts, and mansions standing tall like tombstones (beautiful, empty, and forgotten). You won’t find it on a map, because it was never born. No traffic, no towers, nothing to pierce the clouds. Just the echo of what could’ve been, IF WE HAD DARED TO BUILD. That walk still haunts me. The dream of a city was poured in concrete… then abandoned like an old election promise.

While Singapore turned marshland into money, and Rwanda sculpted vision out of genocide’s shadow, Nigeria sat on oil wells, talent, and time.

Because Nigeria does not just fail to build, it starts, it announces, it raises hopes, then it

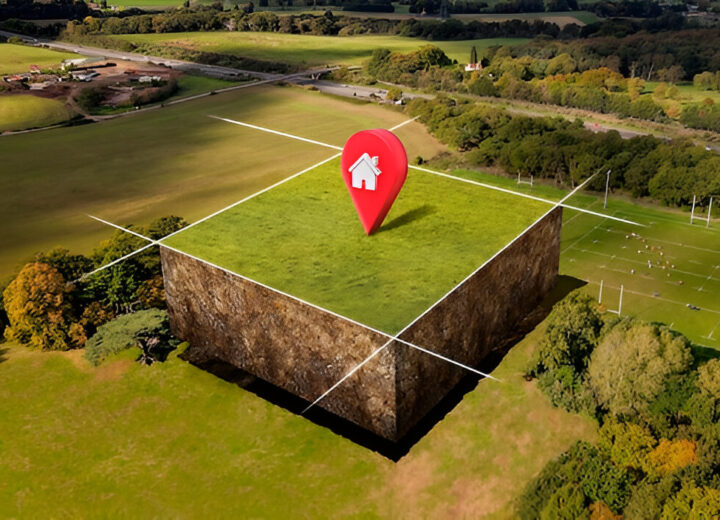

stops. From Lagos to Abuja, abandoned housing estates like the one pictured above remind us that Nigeria’s real estate boom has often left the people behind.

Yes, what it leaves behind are not only unfinished buildings, but generations of Nigerians who

have learned to stop dreaming and are lost in silence.

Who Benefits?

Everywhere you turn in Nigeria’s urban corridors (Abuja, Lagos, Port Harcourt, Enugu) you’ll see unfinished estates, empty towers, and ‘luxury’ properties with no buyers. But is this a supply problem or a system’s failure?

Here’s what we’ve really built:

- Cities with no clear land titles, so developers and buyers live in legal limbo.

- Homes priced in hundreds of millions, for a country where the minimum wage is ₦70,000, and purchasing power of the people is limited.

- Skyscrapers rising on roads that cannot survive rain.

- Ultra-high real estate with no water, no proper drainage.

It would be unfair to say Nigeria’s real estate sector is failing, it isn’t. In fact, the sector is growing and even outpacing oil and gas, ranking as the third-largest contributor to Nigeria’s GDP in 2024 at 5.43% of the national economy. That’s massive progress.

But progress for who?

Because while the industry flourishes, the average Nigerian is locked out of it.

Yes, there’s energy, there’s ambition, and some impressive projects are springing up. But how many can afford them?

Right now, Nigerian real estate is booming, but for the 1% of the 1%. For everyone else, it is a mirage.

The Real Cost Of Our Real Estate Failure

Real estate is supposed to be a solution for this nation but Nigerian real estate has become a gated country club for the elite. The housing deficit now stands at over 28 million units, and as prices climb, so does the pain. While cities like Kigali, Accra, and even Luanda are building inclusive homes, digital land registries, and investor-friendly ecosystems, Nigeria remains trapped in a loop of glossy brochures and broken ground.

Here’s what we see instead:

- Rents in urban areas now average ₦1 million to ₦1.5 million for a tightly-built one-bedroom apartment.

- Young Nigerians stuck in their parents’ homes till 35 (not by choice, but by economic

exclusion). - Middle-income earners pushed to the outskirts, spending hours daily commuting to jobs

in cities they cannot afford to live in. - Women denied land ownership by cultural norms and bureaucratic gatekeepers.

- Families living under bridges five minutes away from N500 million homes.

- Mortgage rates are so high that owning a home feels impossible.

And then there’s this unspoken wickedness of some landlords. They burden tenants with outrageous fees in addition to rent. They let tenants spend so much renovating run down spaces, painting, plumbing, even tiling, using personal resources to turn neglected apartments into better homes. Only to face abrupt eviction after a year, just as they begin to settle. Moreover, the lack of tenant protections and rent measures leaves renters vulnerable to sudden hikes and displacement.

The human toll of these practices is immense, leading to instability and insecurity for countless families, further promoting crime rates in the nation.

I know, Nigeria is not the only country with housing challenges. But some are asking better questions, and getting better answers.

Let’s start using metrics that matter: INCLUSION, AFFORDABILITY, ACCESS, BUYING POWER.

In Singapore, public housing accounts for 90% of homeownership, and this is not by accident, but by intentional planning and policy.

In Morocco, eco-cities like Zenata integrate transport, tech, and sustainability.

In Ghana, despite setbacks, a national Affordable Housing Programme targets real citizens and not only investors.

Ethiopia has built over 300,000 housing units through its Integrated Housing Development Program.

Rwanda enforces its master plan and invests in transit-oriented development (small, but steady).

Meanwhile in Nigeria, we celebrate every new skyscraper in Eko Atlantic like a miracle, even if 90% of Lagosians will never step inside it.

So I wonder

Why do we build cities where only 5% can buy in?

Why is “luxury” the default ambition?

Why do we chase the appearance of developments: flyovers, glass towers, estates with European names, without fixing sustainability and rent structures.

Broke or Broken?

Nigeria’s real estate sector could easily be a trillion-naira industry.

The demand is there. The urbanization is there. The land is there. The capital is waiting.

But the system is broken.

- We lack a national housing plan with targets tied to human dignity, not GDP

slideshows. - We lack transparency, accountability, and a will to democratize land and housing access.

- We lack empathy in how we price, plan, and prioritize.

You cannot fix this with another gated estate.

You fix it by asking:

Who are we building for?

You fix it by ensuring that affordable becomes aspirational. Not everyone wants OR NEEDS a Lekki duplex. But every Nigerian deserves a home.

A nation that builds only for the few does not grow but fractures; and this inequality we cement into our cities shows up in our politics, in our classrooms, even in our japa statistics.

It breeds resentment, migration, and disillusionment. It robs us of community.

The opportunity cost of not building well is staggering:

- We’re losing talent.

- We’re losing tax revenue.

- We’re losing investors.

- Most dangerously, we’re losing trust.

But it doesn’t have to be this way.

This blog series—The City Nigeria Never Built, is not that mere indictment, this one is a blueprint.

In the next two parts, we’ll unpack, in details, the systems Nigeria can redesign, the policies it can reinvent, and the soul it must restore in its urban development. Because real estate is not only about buildings, it is about belonging.

And until we start building cities that work for the many, Nigeria will keep breaking the dream of its best.

🔜 Up next: Series 2 – What Nigeria Can Learn Without Copying